Compound interest calculator with yearly increase

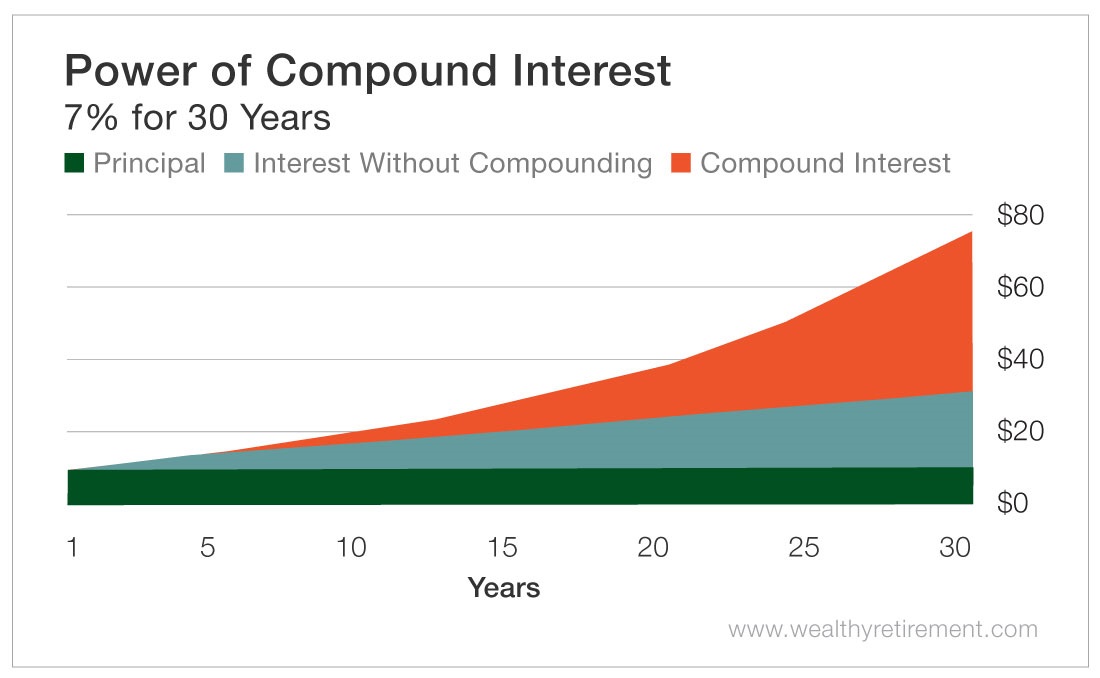

The scope of compound interest is enormous. SIP calculators estimate potential return using the compound interest formula.

Compound Interest Definition Formula How It S Calculated

200 as simple interest.

. The growth of bacteria. Calculate interest compounding annually for year one. Here we are.

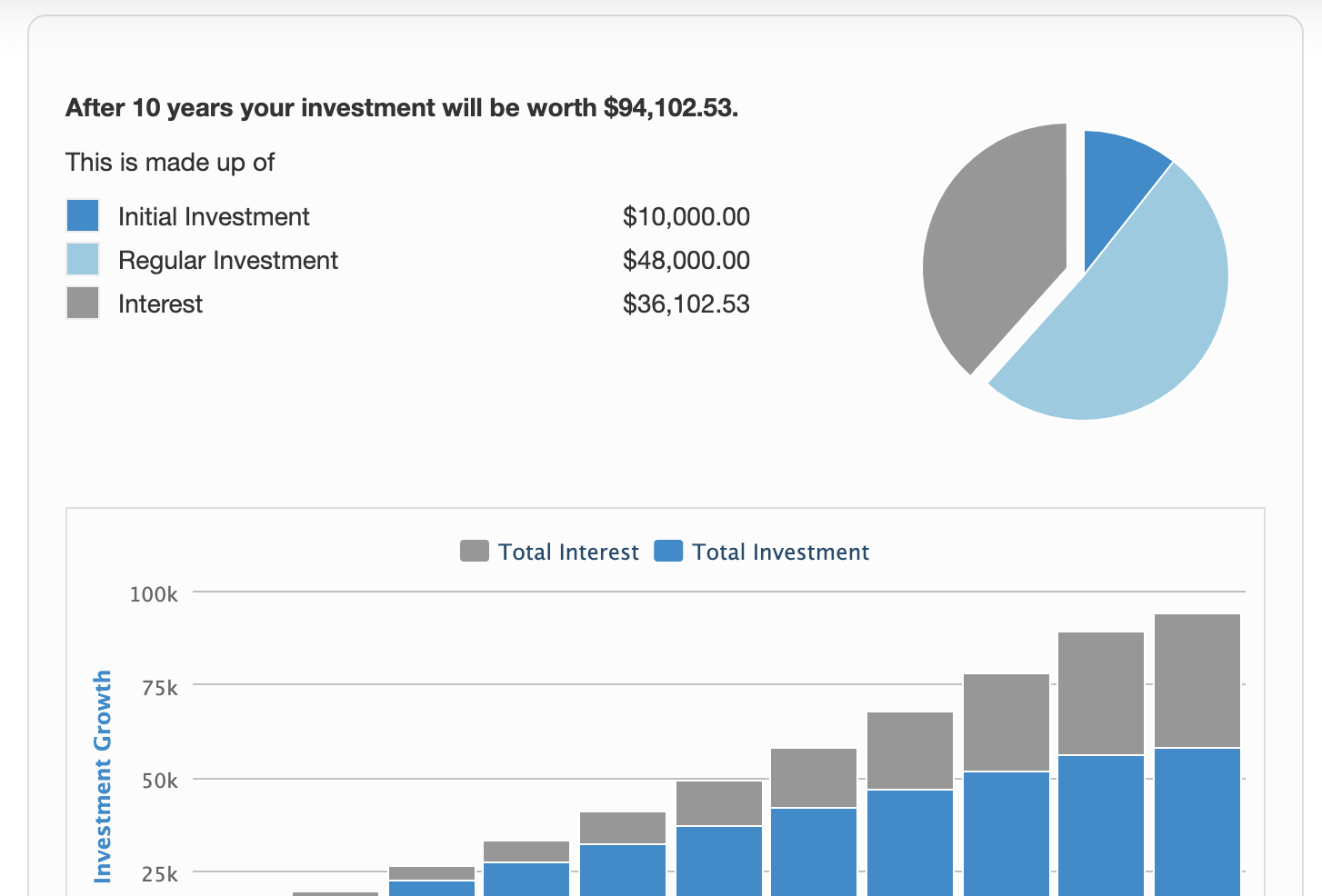

Investors can change the inputs as they wish and test multiple investment scenarios to choose between the best possible outcome. In comparison if a 100 savings account includes an APY of 1047 the interest received at the end of the year is. The interest can be compounded annually semiannually quarterly monthly or daily.

Time 2 years. For example if you earn 5 annual interest a deposit of 100 would gain you 5 after a year. Rise or Depreciation in the value of.

FV PV. Increase or decrease in population. To understand compound interest start with the concept of simple interest.

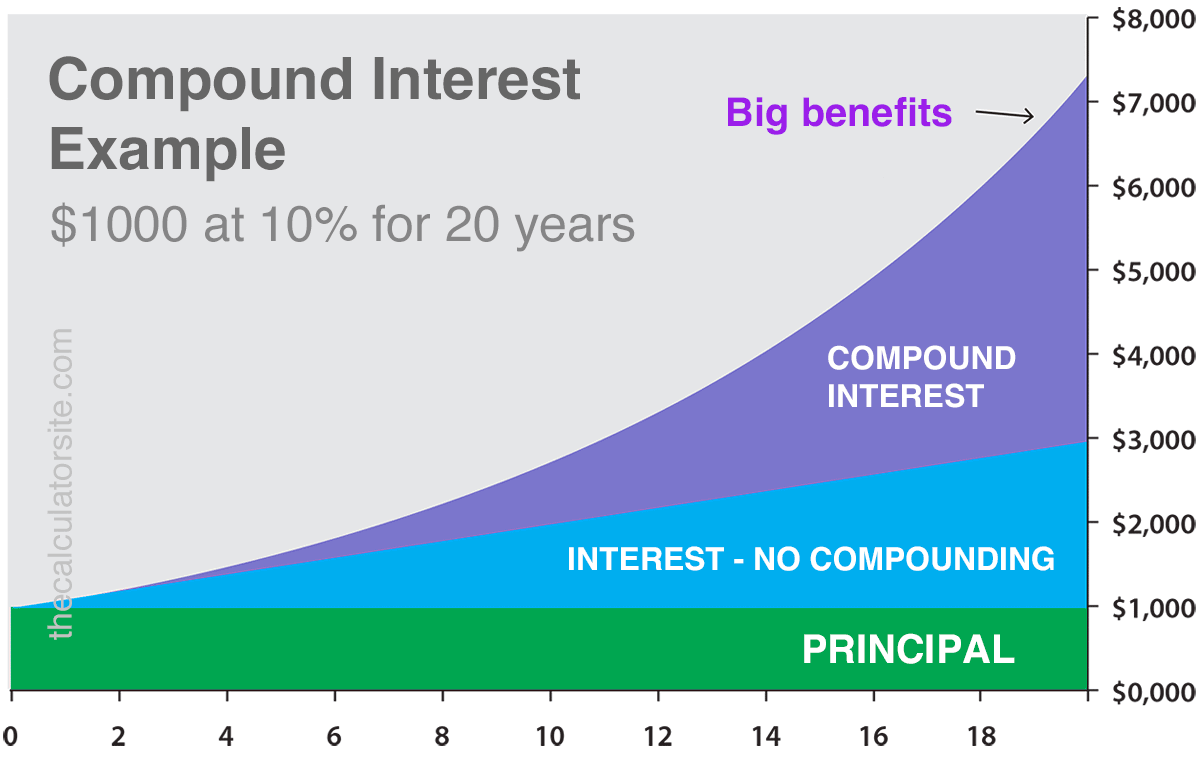

Compound Annual Growth Rate - CAGR. But we are talking about a 10-fold increase at only 5 interest. FV represents the future value of the investment.

Computing Yearly Compound Interest for a Bank X. I Increase yearly contributions by. Find out how it can significantly increase your savings overtime and how it works at HSBC.

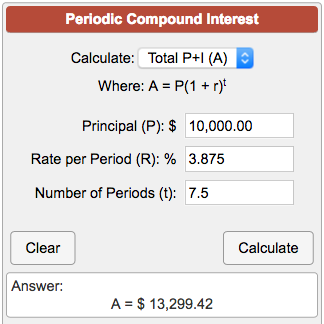

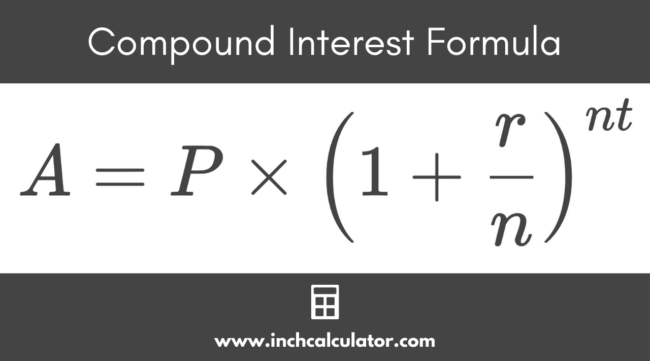

The basic formula for Compound Interest is. Years at a given interest. Please refer to the Compound Interest Calculator to convert between APY and APR or interest rates of different compounding frequencies.

If you initially had 5000 saved up and wanted to deposit 1000 at the beginning of the second year then you would set the initial deposit amount to 4000 as the other 1000 would automatically be added at the. The compound annual growth rate CAGR is the mean annual growth rate of an investment over. For example say you have 100 in a savings account and it earns interest at a 10 rate compounded annually.

It is denoted by P. Given details are Simple interest SI Rs 200. The calculator takes into account the number of times compounding is applicable and estimates the potential returns.

Assuming that that interest is compounded on a yearly basis m 1 we can write. Next figure out the interest rate that is to be charged on the given deposit or loanIt is denoted by r. Use the results to see how much can be saved by making extra payments in terms of interest paid as well as the reduction in loan.

So by using the formula Simple interest PTR100. Compound interest finds its usage in most of the transactions in the banking and finance sectors and other areas. P SI 100 TR.

Year 2 2. Making prepayments can potentially shorten the loan term and reduce the interest payments. And it is also possible to have yearly interest but with several compoundings within the year.

Its a way to measure the growth rate of your investments over time. Heres what you need to know about how credit card interest works. Scripboxs online compound interest calculator is customizable.

Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. Despite appearances 10 APR is equivalent to 1047 APY. Using the compound interest calculator observe the returns for an investment made at a 6 compound.

Include additions contributions to the initial deposit or investment for a more detailed calculation. As you may remember we deposited 2000 for 5 years into a savings account at 8 annual interest rate compounded. I represents the rate of interest earned each period.

To calculate compound interest we use this formula. Compound Annual Growth Rate is an important investment concept thats related to compound interest. Furthermore the SIP calculator requires one to enter the monthly amount they want to invest the duration of the investment in years and the.

100 1047 1047. Compound interest is interest earned on previously earned interest. Credit card interest is calculated based on an accounts average daily balance during the statement period and is compounded daily.

See how much you can save in 5 10 15 25 etc. Find out how it can significantly increase your savings overtime and how it works at HSBC. I also made a Compound Interest Calculator that uses these formulas.

Our compound interest calculator includes options for. I Enter average annual inflation rate. Some of its applications are.

When youre investing to save for retirement you should put your money in mutual funds. You deposit money and the bank pays you interest on your deposit. The formula for compounding can be derived by using the following simple steps.

PV represents the present value of the investment. It makes a sum of money increase at a more rapid rate than simple interest because you will earn returns on the money you invest as well as on returns at the end of every compounding time. So the average yearly increase of Big Bite during the period 2012 2018 was 54682.

Daily monthly quarterly half-yearly and yearly compounding. In the More Options input section of the calculator is an Extra Payments section to input monthly yearly or single payments. FV PV.

Deposits are made at the beginning of each year. Use our free compound interest calculator to estimate how your investments will grow over time. Firstly figure out the initial amount that is usually the opening balance of a deposit or loan.

It is the basis of everything from a personal savings plan to the long term growth of the stock market. The 1000 investment in the example above increased by 983 from year 5 to year 10 and by 7064 from. FV PV x 1 in where.

The above calculator compounds interest monthly after each deposit is made. N represents the number of periods. At the end of the first year.

Interest paid in year 1 would be 60 1000 multiplied by 6 60. In Mathematics compound interest is usually denoted by CI. Future Value Inflation Adjusted.

The detailed explanation of the arguments can be found in the Excel FV function tutorial. In addition you can include negative interest rates and inflation increases as part of your calculation. Rate r 10.

Estimate the total future value of an initial investment or principal of a bank deposit and a compound interest rate. Treasury savings bonds pay out interest each year based on their interest rate and current value. The sooner you start investing the more time you have for interest to compound on interest.

Find the compound interest at the rate of 10 per annum for two years on that principal which in two years at the rate of 10 per annum given Rs. Yearly interest of 15 AER Gross 1510 1510 Closing balance. However interest charges are usually waived when cardholders pay their entire statement balance by the due date.

If you need to find out more about compound interest and ways to calculate it check out our compound interest calculator link above. The above calculator compounds interest yearly after each deposit is made. Choose daily monthly quarterly or annual compounding.

In the meantime lets build a FV formula using the same source data as in monthly compound interest example and see whether we get the same result. Step by Step Guide to Create a Daily Compound Interest Calculator in Excel. Assume that you own a 1000 6 savings bond issued by the US Treasury.

Compound Interest Calculator Crown Org

Walletburst Compound Interest Calculator With Monthly Contributions

Compound Interest Calculator Arrest Your Debt

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

Compound Interest Calculator

How Can I Calculate Compounding Interest On A Loan In Excel

Compound Interest Calculator With Formula

Quarterly Compound Interest Formula Learn Formula For Quarterly Compound Interest

Compound Interest Calculator Financeplusinsurance

Compound Interest Calculator Daily Monthly Yearly

Compounding Interest Formulas Calculations Examples Video Lesson Transcript Study Com

Periodic Compound Interest Calculator

Compound Interest Calculator Inch Calculator

Daily Compound Interest Formula Calculator Excel Template

Compound Interest Calculator Set Your Own Compounding Periods

26 Compound Interest Formula Exponential Growth Of Money Part 1 Calculate Compound Interest Youtube

Compound Interest Calculator For Excel